Social security schemes in India play a crucial role in providing financial stability, healthcare, and employment opportunities to different sections of society. These schemes are introduced by the government to support the economically weaker sections, senior citizens, women, and farmers. This guide explores some of the top social security schemes in India, their benefits, and eligibility criteria.

What Are Social Security Schemes?

Social security schemes are government-backed programs aimed at providing financial aid, health insurance, pensions, and employment support to various sectors of society. These schemes are designed to uplift the underprivileged and ensure economic stability.

Top Social Security Schemes in India

1. Pradhan Mantri Jan Dhan Yojana (PMJDY)

Objective: Financial inclusion for all.

Key Benefits:

- Zero balance savings accounts for all.

- Accidental insurance cover up to Rs. 2 lakh.

- Overdraft facility of up to Rs. 10,000 for eligible account holders.

Eligibility:

- Any Indian citizen above 10 years of age can open an account.

2. Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Objective: Providing life insurance at affordable rates.

Key Benefits:

- Life insurance coverage of Rs. 2 lakh.

- Annual premium of just Rs. 330.

- Available to individuals aged 18-50 years.

Eligibility:

- Any individual with a savings bank account can enroll.

3. Pradhan Mantri Suraksha Bima Yojana (PMSBY)

Objective: Providing accident insurance coverage.

Key Benefits:

- Accidental death or disability cover of Rs. 2 lakh.

- Annual premium of Rs. 20 only.

- Coverage for individuals aged 18-70 years.

Eligibility:

- Any individual with a bank account.

4. Atal Pension Yojana (APY)

Objective: Ensuring old-age pension security.

Key Benefits:

- Guaranteed pension ranging from Rs. 1,000 to Rs. 5,000 per month after 60 years.

- Contribution-based pension scheme.

Eligibility:

- Open to citizens between 18-40 years.

- Mandatory to contribute for at least 20 years.

5. National Pension System (NPS)

Objective: Providing a retirement savings scheme.

Key Benefits:

- Investment-based pension plan.

- Partial withdrawal options for emergency needs.

- Tax benefits under Section 80C and 80CCD.

Eligibility:

- Open to Indian citizens between 18-65 years.

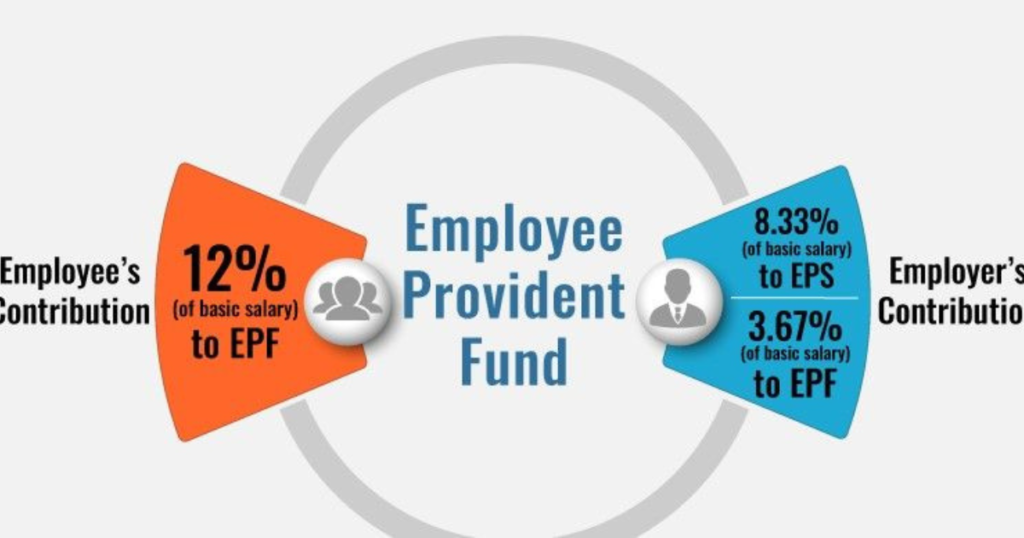

6. Employees’ Provident Fund (EPF)

Objective: Retirement and financial security for employees.

Key Benefits:

- Monthly contributions by employees and employers.

- Lump sum withdrawal after retirement.

- Tax benefits on contributions.

Eligibility:

- Mandatory for employees earning up to Rs. 15,000 per month.

- Voluntary option available for higher-income employees.

7. Rashtriya Swasthya Bima Yojana (RSBY)

Objective: Providing health insurance to BPL families.

Key Benefits:

- Medical coverage up to Rs. 30,000 per family per year.

- Covers hospitalization expenses.

- Cashless treatment at registered hospitals.

Eligibility:

- Families belonging to the Below Poverty Line (BPL) category.

8. Ayushman Bharat – Pradhan Mantri Jan Arogya Yojana (PMJAY)

Objective: Universal health coverage for economically weaker sections.

Key Benefits:

- Health coverage up to Rs. 5 lakh per family per year.

- Covers secondary and tertiary hospitalization.

- No cap on family size or age.

Eligibility:

- Families identified under the Socio-Economic Caste Census (SECC) database.

9. Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA)

Objective: Providing guaranteed employment.

Key Benefits:

- 100 days of guaranteed wage employment per year.

- Women are given equal pay.

- Development of rural infrastructure.

Eligibility:

- Any adult member of a rural household willing to do unskilled manual work.

10. Indira Gandhi National Old Age Pension Scheme (IGNOAPS)

Objective: Financial assistance to senior citizens.

Key Benefits:

- Monthly pension ranging from Rs. 300 to Rs. 500.

- Additional state government top-ups in some regions.

Eligibility:

- Citizens aged 60 years and above belonging to the BPL category.

Also Read: Beti Bachao Beti Padhao Yojana: Empowering Girls For A Brighter Future

Conclusion

India’s social security schemes aim to provide financial support, employment, health benefits, and pension security to various sections of society. These schemes not only enhance economic stability but also ensure a better standard of living for the underprivileged. By enrolling in these programs, individuals can secure their future against uncertainties and financial hardships.

FAQs

1. Who can apply for social security schemes in India?

Most schemes are designed for the economically weaker sections, senior citizens, and employees. Eligibility criteria vary for each scheme.

2. Are these schemes free of cost?

While some schemes, like MGNREGA, provide direct benefits, others require a nominal contribution, such as Atal Pension Yojana and NPS.

3. How can I apply for these schemes?

Applications can be made through government portals, banks, and local government offices.

4. Are these schemes available for private-sector employees?

Yes, schemes like EPF and NPS are applicable to private-sector employees.

5. How do social security schemes help in financial security?

These schemes provide insurance, pensions, employment, and healthcare benefits, ensuring long-term financial stability for individuals and families.